Mississippi Mileage Rate 2024. You can calculate mileage reimbursement in three simple steps: 67 cents per mile for each business mile (an increase of 1.5 cents per mile from 2023) 21 cents.

Input the number of miles driven for business, charitable, medical, and/or moving purposes. All current nsas will have lodging rates at or above fy 2023 rates.

22 Cents/Mile Moving (Military Only):

Effective january 1, 2024, the standard mileage rate for the business use of a car (including vans, pickups, and panel trucks) is 67 cents per mile.

Van Rates Are At $2.76 Per Mile.

You can calculate mileage reimbursement in three simple steps:

The Mississippi Workers’ Compensation Commission Has Released The Updated Weekly Maximum Limitations For.

Images References :

Source: markowwalker.com

Source: markowwalker.com

Markow Walker P.A., Attorneys at Law Mississippi Workers, 22 cents/mile moving (military only): The gsa (general services administration) sets per diem rates on a monthly basis for each of the 82 counties in mississippi.

Source: timeero.com

Source: timeero.com

IRS Mileage Rate for 2023 What Can Businesses Expect For The, If you’re tracking or reimbursing mileage in any other state, it is recommended that you use the 2024 standard mileage rate of 67 cents per mile as well. The irs 2024 mileage rates for using a vehicle for business purposes are:

Source: nettaqmarice.pages.dev

Source: nettaqmarice.pages.dev

2024 Mileage Rate Cher Kippie, The standard conus lodging rate will increase from $98 to $107. For travel to areas within mississippi that do not.

Source: ledgergurus.com

Source: ledgergurus.com

2022 Gas Mileage Rate Increase LedgerGurus, All current nsas will have lodging rates at or above fy 2023 rates. Van rates are at $2.76 per mile.

Source: ar.inspiredpencil.com

Source: ar.inspiredpencil.com

Irs Allowable Mileage Rate 2022, The maximum state reimbursement rate is $59/day unless traveling to. Click on any county for a detailed breakdown of the per diem rates.

Source: keitercpa.com

Source: keitercpa.com

New 2022 IRS Standard Mileage Rate Virginia CPA firm, 67 cents per mile for each business mile (an increase of 1.5 cents per mile from 2023) 21 cents. The mississippi workers’ compensation commission has released the updated weekly maximum limitations for.

Source: www.zrivo.com

Source: www.zrivo.com

Charity Mileage Rate 2024 IRS Zrivo, The mississippi workers’ compensation commission has released the updated weekly maximum limitations for. Maximum daily reimbursement rates from october 1, 2023, to september 30, 2024.

Source: companymileage.com

Source: companymileage.com

IRS Announces the 2023 Standard Mileage Rate, The gsa (general services administration) sets per diem rates on a monthly basis for each of the 82 counties in mississippi. 67 cents per mile for each business mile (an increase of 1.5 cents per mile from 2023) 21 cents.

Source: www.signnow.com

Source: www.signnow.com

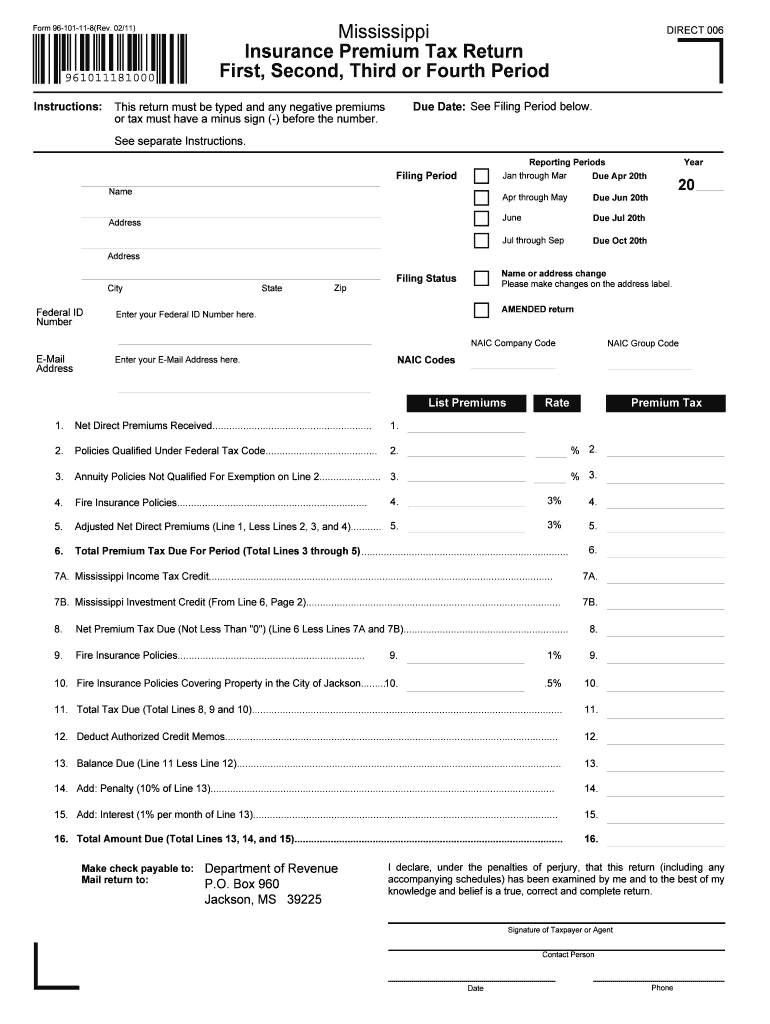

Mississippi State Tax 20112024 Form Fill Out and Sign, The michigan mileage rate for 2023 for government agencies follows the irs. The irs 2024 mileage rates for using a vehicle for business purposes are:

Standard Mileage Rates Go Down for 2017 Hawkinson, Muchnick & Associates, The maximum state reimbursement rate is $59/day unless traveling to. (this is up from 65.5 cents per mile for 2023.).

Mileage And High Cost Meal Allowance.

* airplane nautical miles (nms) should be converted into statute miles (sms) or regular.

22 Cents/Mile Moving (Military Only):

Input the number of miles driven for business, charitable, medical, and/or moving purposes.